In Italy, Buoni del Tesoro Poliennali(BTp) and Buoni Ordinari del Tesoro(BOT) represent two of the main types of government bonds issued by the Italian government to finance public debt. These financial instruments are critical to the management of state finances and offer investors different investment opportunities and returns, depending on their liquidity needs and time horizons.

Let’s analyze the topic together by taking an overview of these investment instruments!

1. The long wave of interest rates and the consequences for government bonds

To counter inflation, both Europe and the United States have focused on sharply raising interest rates. Both the ECB and the Federal Reserve have moved in the same way to curb demand for access to credit and stop inflation. When rates rise, so do expected bond yields.

Therefore, during market phases of rising rates, the conscious investor aims to expand his or her portfolio of BOTs, BTp and other bonds to be able to take advantage of the long wave of high interest rates.

2. What are BTPs?

To understand what pays best, one needs to know the difference between BTp and BOT. Multi-year Treasury Bonds (BTp) are medium- to long-term bonds with a fixed coupon paid semi-annually. They can be issued with maturities of 18 months, 3, 5, 7, 10, 15, 20, 30 and 50 years through a process called marginal auction.

The yield on BTp is derived partly from the coupon flow and partly from the difference between the subscription or purchase price and the face value (equal to 100) that is redeemed at maturity.

3. What are BOTs?

BOTs, or Treasury bills, are government securities. Specifically, they are short-term debt securities with maturities set within one year, with different denominations of 3, 6 or 12 months.

The short term within which the transaction is opened and closed means that underwriters face less risk and consequently lower returns than with government bonds with longer maturities, such as BTps. Unlike the latter, they do not distribute coupons.

4. What to choose?

In order to assess which instrument to prefer, one must first ask oneself whether one will need the invested liquidity within a short time. Where such a need is found, BOTs are the best solution because they are of shorter duration.

Where this requirement is lacking, a freer choice can be considered by going to the list of medium- and long-term BTp’s, which can be found on the Italian Stock Exchange’s list, and which provides comprehensive information regarding expected yield, maturity and historical performance.

5. Capital gains on government securities

The capital gain that is realized is subject to the 12.50 percent substitute tax.

This taxation that applies to both issues of the Italian Treasury Department and government securities issued by other public issuers.

6. Government bonds: a debt instrument for the country

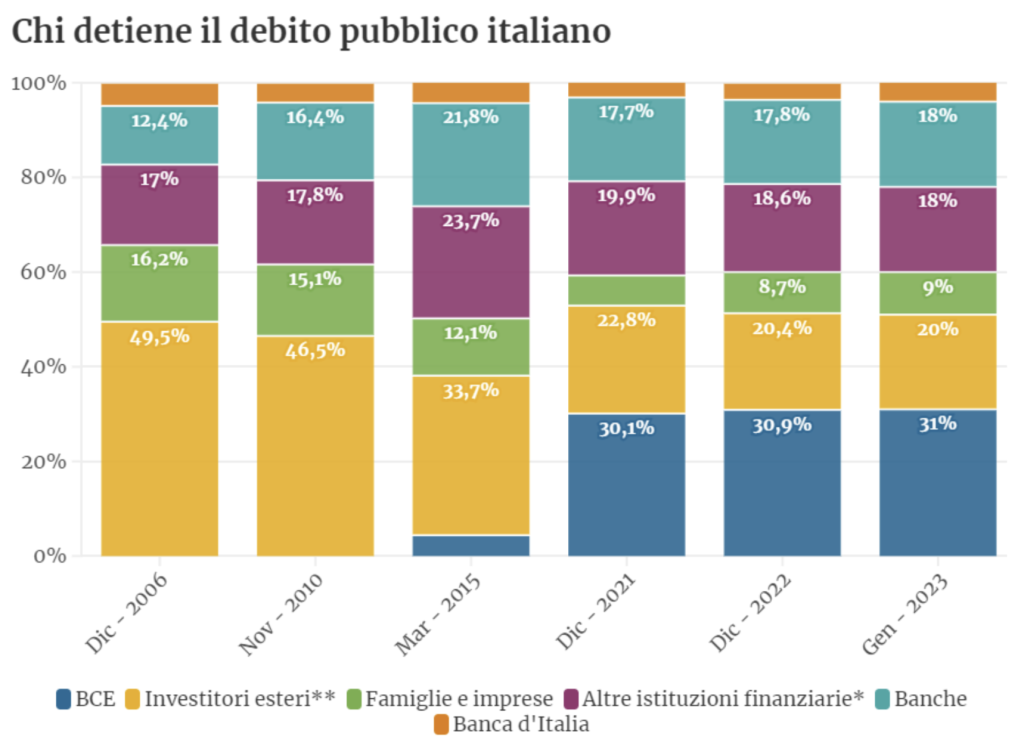

Italy has one of the highest public debts in the world, amounting to 2,840 billion euros and over 140 percent of Gross Domestic Product.

Such a figure may seem hard to imagine, yet there are many creditors behind this amount of debt, which are concrete entities: central banks, commercial banks, Italian and foreign investment funds, and even ordinary people who have decided to invest their savings.

Each of these creditors holds a piece of the public debt through so-called government bonds, that is, financial instruments with which the state borrows money to finance its public spending, and on which it pays interest; at the same time, those who lend to it make an investment that allows them to earn income.

7. There is not a single title

The Ministry of Economy has created various types of government bonds to make them attractive in the market and suitable for a wide range of needs. They differ in their maturities, the way interest is paid, whether or not they are indexed to inflation, among other things.

BOTs and BTp are the most traditional government bonds. These are two basic models, from which the Ministry of Economy then created some variations over time to make investments in government bonds attractive depending also on the historical period. The basic mechanism, however, is the same for everyone: you buy bonds by paying money to the government, which will then be returned at maturity with interest.

For example, there are inflation-linked government bonds, similar to BTp whose coupons and final repayment are, however, indexed to European inflation, or the BTp Italia, which is instead indexed to Italian inflation: meaning that if one year inflation in Italy is 4 percent, the coupon of the indexed bond will also increase by 4 percent.

At the beginning of the COVID-19 pandemic, the Ministry of Economy created BTp Futuras, which aimed to raise money to support the economy during the economic crisis triggered by the pandemic. BTp Valore, which can only be bought by small savers, was also recently created. These provide a periodic coupon and a premium if the security is held to maturity, a circumstance that concerns the private saver more, while professional investors tend not to.

8. How and where do you buy BTp and BOT?

Government bonds can be bought in two ways:

- The first is on the so-called primary market, only when bonds are issued: the Ministry of the Economy offers them to buyers through auctions that the Bank of Italy oversees and in which one must register, indicating the value of the bonds one intends to buy and at what price. Only authorized investors, such as investment funds and banks, can participate in these auctions: if a person wants to buy government bonds on the primary market, he or she must give a mandate to his or her bank, which will bid on his or her behalf, or he or she can do so through his or her home banking platform if it is enabled for trading. Purchases generally have minimum denominations of 1,000 quantities.

- The second way by which government bonds can be bought is on the secondary market, that is, on the stock exchange through the MOT, the Mercato Telematico delle Obbligazioni e dei Titoli di Stato, which is operated by Borsa Italiana. It is an online portal that can always be accessed through a financial intermediary; the difference is that on the secondary market, you can buy securities that have already been issued and are outstanding, not only at a specific time but every day that the stock exchange is open. Again, the minimum bid amount is 1,000 quantities.

9. BTp and BOT: who buys these securities?

For years, the share of private savers in the total holding public debt has been lower than about 20 years ago, when it was around 16 percent: it is currently only 9 percent, despite growth in the past three years. The largest share is held by central banks: the European Central Bank and the Bank of Italy hold about 35 percent.

(Source Bank of Italy)