BTP Valore, BTP Green, or more simply BTP, 2024 was a record year for new issues of Italian government bonds, which enticed everyone: funds, institutions but also private citizens hunting for safe yields.

The year 2024 will be remembered as an extraordinary year for Italian government bond issuance, with BTPs (Multi-Year Treasury Bonds) experiencing record levels of investor demand and interest.

In particular, different categories of BTPs, such as the BTP Valore and BTP Green, have consolidated Italy’s role in the European and global financial landscape.

Among the most notable results were the issues of the 10-year BTP and the BTP Green. The former attracted demand in excess of 140 billion euros, while the latter, with a 20-year maturity, garnered demand close to 130 billion euros.

Overall, the collection reached about 270 billion euros, marking an all-time record for the country.

The success of these bonds reflects not only the attractiveness of Italian government debt, but also the growing investor awareness of sustainable financial instruments. The BTP Green, in particular, is a clear signal of Italy’s commitment to supporting the ecological transition by financing projects related to environmental sustainability and carbon emissions reduction.

The record year for bond issuance was also made possible by a global economic environment that fostered interest in safe, high-yielding instruments. Italy was able to take advantage of this scenario, offering securities with competitive and solid yields, capable of attracting both institutional and retail investors.

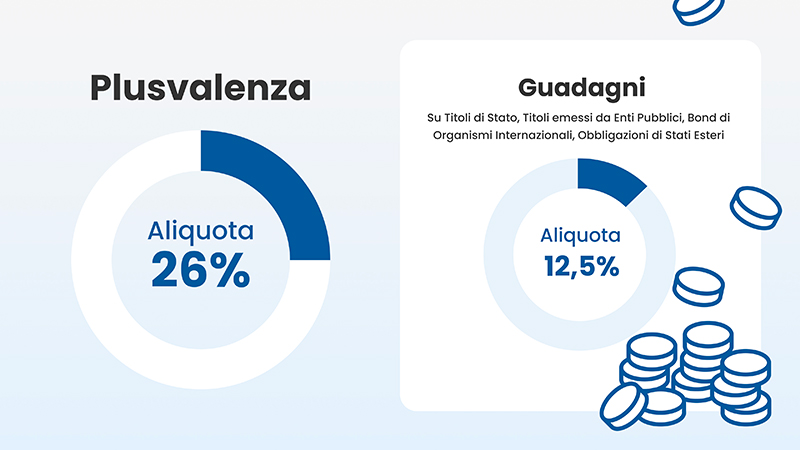

During 2024 Italian citizens were attracted not only byyields on the 10-year bond that exceeded 4 percent gross at certain times, but also by the tax breaks the instrument allows on realized capital gains: 12.50 percent tax on capital gains, less than half the 26 percent tax rate for corporate bonds.

To better understand the dynamics related to BTPs, let us see below concrete examples on two instruments purchased on the same date, with the same coupon, at the same price, and with the same maturity.

1. Capital gains and taxation of BTPs

The purchase of €1,000 of a BTP with a 4-year maturity and a 4% coupon purchased at a price of 90.00 will accrue two types of returns:

- coupons for a total of 4% per year for each year of holding

- an appreciation of the stock, which will be redeemed at 100.00 compared to the book price of 90.00.

The “gross” yield of a BTP with these characteristics will be identical to that of a corporate bond having the same purchase price, same maturity, same coupon.

This yield will generate a capital gain for us, however, which in government bonds enjoys a tax-advantaged rate compared to a regular corporate bond.

So if we look, however, at the net return of the two products, that is, the return after taxation, we realize the significant difference that arises precisely from the tax-advantaged nature of government bonds compared to corporate bonds.

Again following the example above, the net coupon of the 4% BTP is 3.50% per annum, compared with 2.96% for the corporate bond.

Out of 1,000 euros of investment, over 4 years the government bond thus accrues as much as 140 euros in net coupons compared to 118.40 euros for the corporate bond.

In addition, on theappreciation of the bond redeemed at 100.00 against a purchase price of 90.00, again following the example above, the BTP acc rues an additional after-tax capital gain of 87.50 euros, unlike the corporate bond, which will accrue an additional after-tax capital gain of 74 euros.

Overall, therefore, the return on a 1,000-euro BTP investment, again following the example above, will total 227.50 euros, while that of the corporate bond will be 192.40 euros.

2. In case of capital losses what can I do ?

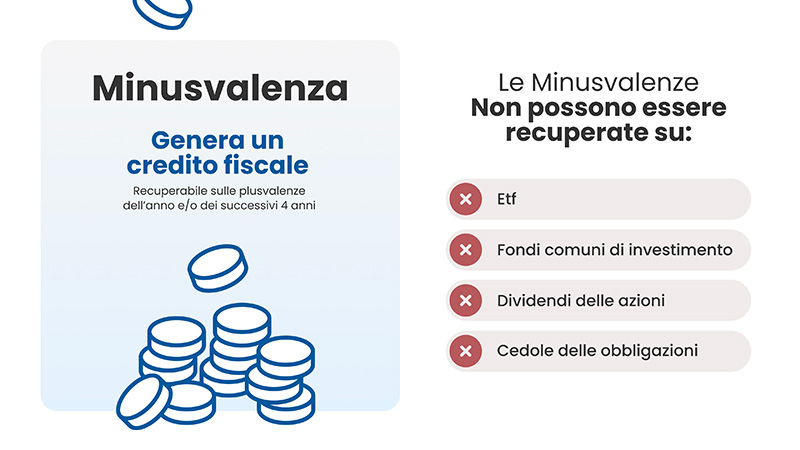

If you have purchased a BTP (Multi-Year Treasury Bond) and experienced a capital loss, there are a few options you can consider to handle this situation.

But when does a capital loss occur ? A capital loss on a BTP (Multi-Year Treasury Bond) occurs when you sell the security for less than the price at which you bought it. This often happens because of changes in interest rates or in the perceived risk associated with the security.

Example:

- Suppose we buy a BTP with a maturity of 10 years and a face value of €10,000, priced above par i.e. at 102 on a face value of 100. The price paid will be: € 10,000 x 102% = € 10,200

- After a few years, market interest rates rise. This drives down the price of BTP on the secondary market, because new government bonds offer higher yields and are therefore more attractive.

- You decide to sell the BTP in the market at the price of 98 of the face value. So you get € 10,000 x 98% = € 9,800

- Capital loss calculation: capital loss is the difference between the purchase price and the selling price, so our result will be €10,200-€9,800= €400 (capital loss)

In this case what caused the capital loss ?

The reasons for a price reduction can be as varied as:

- markets collapse

- spread increase

- political uncertainties in the issuing country

- negative change in currency exchange rate

- etc…

What can I do ?

First, you can offset the capital loss on BTPs against future capital gains.

Capital losses from the sale of financial instruments can be used to offset future capital gains. In Italy, you can use the capital loss to reduce your capital gains tax liability within 4 years of the year in which it occurred.

For example, if you sell another investment (stocks, bonds, funds, etc.) at a profit, you can offset that gain against the prior capital loss, reducing or zeroing the tax due.

If you operate under an administered regime (e.g., through a bank or broker), capital losses are automatically offset by the broker.

Under the declarative regime, you will have to report capital losses manually on your tax return ( RT form of 730 or Unico) so that they can be carried forward in subsequent years.

In case you have suffered capital losses, to avoid further losses, consider a portfolio diversification strategy. Reducing your exposure to a single type of instrument (such as government bonds) can limit your overall risk.