The Italian stock index has a strong concentration of financial stocks, which have significantly influenced the returns of the entire basket since mid-2023.

This is similar to the S&P500 in the U.S., driven by Nvidia and a few other tech stocks.

1. THE CORRELATION BETWEEN THE FINANCIAL SECTOR AND THE FTSE MIB

According to Angelo Meda, CFA of Banor Capital, “Our stock index is characterized by a strong concentration in the financial sector. This can cause significant differences between the main FTSE MIB index and the Star small and mid caps index, which is more exposed to the so-called Italian champions, i.e., companies that operate in niche sectors both domestically and internationally and that in the long run tend to follow the dynamics of the Nasdaq.”

Meda also pointed out that the FTSE MIB index has outperformed the Star for three consecutive years, an unprecedented event explained by “the change in the regime on interest rates that has completely altered the perception and valuation of the banking sector.”

2. ITALIAN MARKET OUTLOOK: FROM RATE CUT TO EUROPEAN ELECTIONS

According to Massimo Trabattoni, head of Italian equity at Kairos, clear signs of a reversal of underperformance trends for small and medium-sized Italian companies have emerged since the beginning of June.

The prospect of repeated rate cuts by central banks could provide a decisive boost to this asset class.

At the same time, there was an opposite effect after the European parliamentary elections, with an obvious market correction. “In particular, the French president’s decision to call early elections on June 30 triggered a significant risk off,” notes Andrea Randone, head of mid and small cap research at Intermonte.

Intermonte focuses on stocks with low debt, good cash generation and exposure to solid international trends. “The liquidity picture remains difficult for small- and mid-cap companies, but there are some signs of improvement,” he concludes.

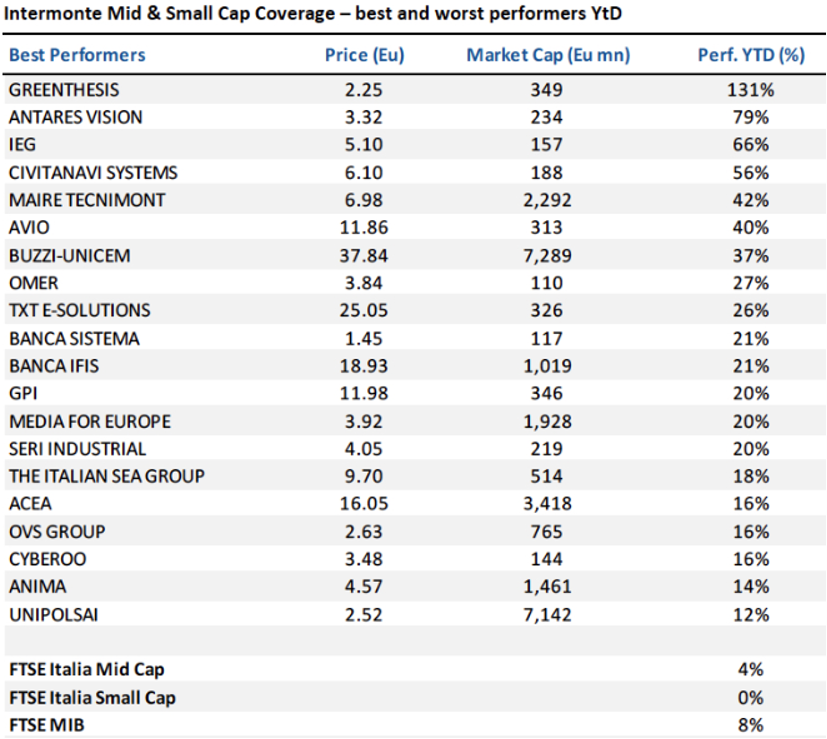

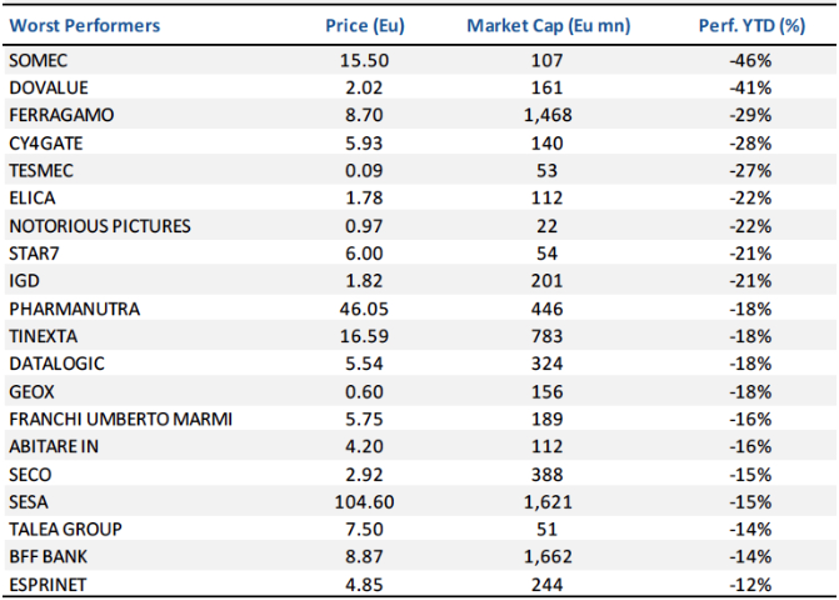

3. LISTED SMES: WHICH ONES BEAT THE FTSE MIB?

The analysis since the beginning of the year sees endless Greenthesis leading the way with a three-digit performance (+131%), joined by Antares Vision (+79%) and Ieg (+66%). On the opposite side, cashing in on the worst performance among Italian mid and small caps are Somec (-46%), Dovalue (-41%), and Ferragamo (-29%).

Source: Intermonte