In financial circles, the concepts of “hard landing,” “soft landing,” and “no landing” describe various perspectives on future economic conditions and the implications these may have on financial markets.

Soaring inflation and the need for central banks to raise interest rates to curb it have long led analysts to imagine recession scenarios in both Western and emerging markets. However, the demonstrated economic resilience has brought a recent flurry of optimism.

Those who imagined a “hard landing” in the markets first envisioned a “softer” scenario, and today even the possibility of a healthy, steadily growing market.

1. Hard Landing

A “hard landing” occurs when an economy goes from a period of strong economic growth to an abrupt slowdown or recession .

This can be caused by a number of factors, including excessive credit expansion, asset bubbles, external economic shocks or tight monetary policies.

During a “hard landing,” financial markets tend to experience significant corrections, with declines in stock, bond and commodity prices, along with increased market volatility.

2. Soft Landing

A “soft landing,” on the other hand, occurs when an economy is able to slow its growth rate without falling into a recession.

During a “soft landing,” the economy makes a gradual transition to a more sustainable pace of growth, avoiding sharp setbacks or turmoil in financial markets.

This can be achieved through prudent economic policy, effective regulation and careful management of market participants’ expectations.

3. No Landing

The concept of “no landing” refers to the prospect that the economy will continue to grow at a steady pace without experiencing either a “hard landing” or a “soft landing.”

From this optimistic perspective, the economy is able to maintain a sustainable level of economic growth without encountering significant obstacles or external shocks.

However, it is important to note that continuous and uninterrupted growth is rare, and economies can encounter challenges and obstacles over time.

4. Implications for financial markets

The prospects of “hard landing,” “soft landing,” or “no landing” have significant implications for financial markets. During a “hard landing,” investors tend to reduce exposure to risky markets and seek safe havens, such as government bonds and gold.

During a “soft landing,” financial markets can remain relatively stable, with investment opportunities arising in resilient sectors of the economy.

In the case of a “no landing,” investors may continue to look for growth and yield opportunities in equity markets and other risky assets.

OECD sees no landing as US yields take off

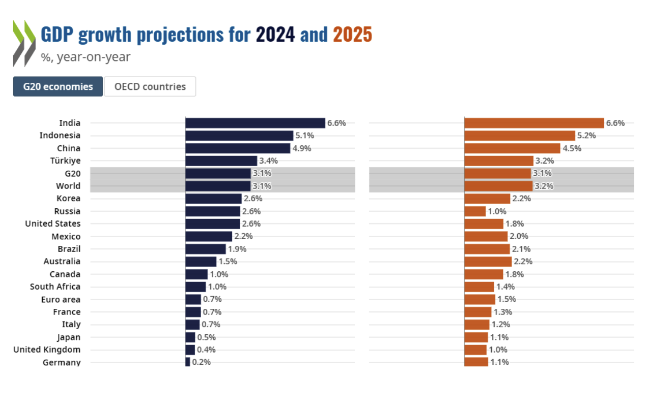

The hypothesis of a “no landing” for the global economy was actually espoused in the latest economic estimates provided by the OECD on May 2, in which a growth rate of 3.1 percent for 2024 is projected, continuing last year’s trend. The estimates were revised upward by two decimal places from last February. The same improvement is also made in the forecast for 2025, which is increased from 3 to 3.2 percent.

“Cautious optimism has begun to take hold in the global economy, despite modest growth and the lingering shadow of geopolitical risks. Inflation is falling faster than expected, labor markets remain strong with unemployment at or very close to historic lows,” commented the Organization for Cooperation and Development’s chief economist, Clare Lombardelli.

Speaking of divergent growth rates, the United States will proceed at a significantly faster pace than the Eurozone according to the OECD, with growth rates at 2.6 and 0.7 percent for 2024, respectively (versus previous estimates at 2.1 and 0.6 percent). The U.S. will continue to do better than the Eurozone next year, with growth projected at 1.8 percent, +1.5 percent compared to the Eurozone.